Money is a subject that elicits a wide range of emotions and beliefs in people, often shaping their financial decisions and behaviors. Many individuals grapple with financial challenges, either due to deeply ingrained money mindsets or the lack of self-awareness when it comes to their financial patterns. Transforming your money mindset and improving your financial well-being begins with self-awareness. It’s the first step on the path to understanding, changing, and ultimately mastering your relationship with money. In this blog post, we will explore the crucial role of self-awareness in the transformation of your money mindset. We’ll delve into how self-awareness helps identify patterns, understand triggers, set clear financial goals, and embrace change, all of which are fundamental to reshaping your relationship with money.

The Power of Self-awareness in Money Mindset Transformation

Money is more than just a medium of exchange; it carries significant emotional and psychological weight. Our relationship with money is deeply rooted in our upbringing, experiences, and beliefs. The money mindset you possess can either propel you to financial success or hinder your financial growth. Self-awareness is the cornerstone of any transformation, especially when it comes to your money mindset. Let’s break down the various aspects in which self-awareness plays a pivotal role in reshaping your financial beliefs and behaviors.

1. Identification of Patterns

Self-awareness is the key to identifying recurring patterns in your financial decisions and behaviors. By looking within and reflecting on your past financial choices, you can gain insight into your money mindset. You might start noticing patterns such as consistently underpricing your services due to self-doubt, overspending when stressed, or avoiding investments due to fear. Recognizing these patterns is the first step towards change.

An Underpricing Dilemma

Meet Jane, a freelance graphic designer from my hometown who faced a persistent challenge of underpricing her services. As her coach, I worked with her on a transformative journey towards self-awareness. Together, we explored her consistent self-doubt when setting her rates, a pattern she uncovered through our coaching sessions. This newfound self-awareness enabled Jane to identify the root cause of her financial struggles and empowered her to actively reshape her pricing strategy which had a profound effect on her business.

2. Understanding Triggers

Self-awareness empowers you to recognize the triggers that provoke negative money emotions, such as stress, fear, or guilt. Money-related stressors can take various forms, like mounting bills, impending deadlines, or the pressure to maintain a certain lifestyle. Understanding these triggers is essential because it allows you to develop strategies for managing them.

Mark’s Stress-induced Spending

Mark, a young store owner, often found himself overspending when he felt overwhelmed by work-related stress. Through our work together on self-awareness, he was able to connect his spending habits to his stress triggers. This awareness led him to explore healthier ways of dealing with stress, ultimately curbing his impulsive spending.

3. Setting Clear Goals

When you are self-aware, you can set specific financial goals that align with your desired money mindset. Clarity in your goals is essential, as it provides direction and motivation for your financial journey. Whether your goal is to increase your income, save for a major life event, or improve your overall relationship with money, self-awareness helps you articulate and prioritize these objectives.

4. Embracing Change

Self-awareness empowers you to embrace change. You’ll be more open to shifting your mindset as you understand the impact it has on your life and entrepreneurial endeavors. Changing your money mindset may require challenging deep-seated beliefs and making uncomfortable decisions. However, with self-awareness, you can navigate these changes more effectively.

Developing Self-awareness in Money Matters

Now that we understand the significance of self-awareness in money mindset transformation, it’s crucial to explore how to develop self-awareness in the realm of finances. Here are some practical steps you can take:

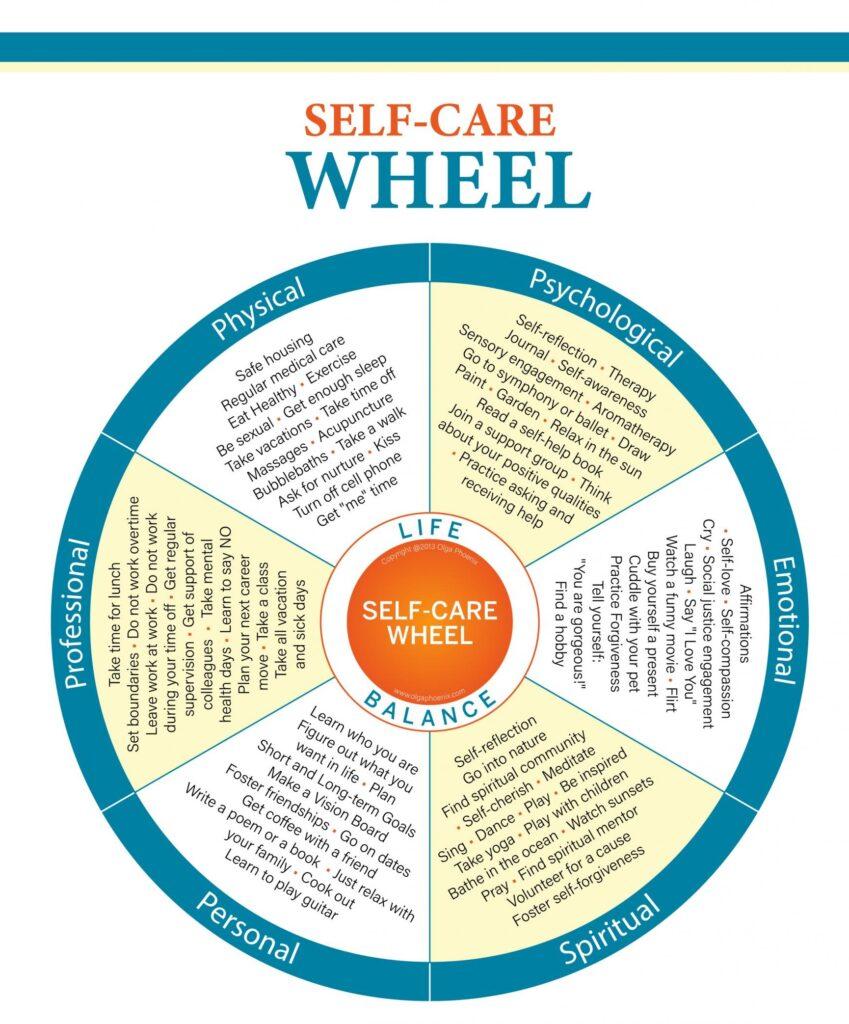

1. Journaling

Keeping a financial journal can be a powerful tool for self-awareness. Write down your financial decisions, feelings, and observations. Over time, patterns and triggers will emerge, allowing you to understand your relationship with money better.

2. Seek Feedback

Engage in open and honest conversations about money with trusted friends, family members, or financial advisors. External perspectives can provide valuable insights into your financial behaviors and beliefs.

3. Self-reflection

Take time to regularly reflect on your financial decisions and their outcomes. Consider how your beliefs and emotions influence your choices. Self-reflection can be a profound way to develop self-awareness.

4. Meditation and Mindfulness

Practices like meditation and mindfulness can help you become more aware of your thoughts and emotions. This heightened awareness can extend to your financial decisions and behaviors.

5. Professional Help

If you find it challenging to uncover your financial patterns or triggers, consider seeking help from a financial therapist or counselor. They are trained to assist individuals in developing self-awareness regarding their financial beliefs and behaviors.

Self-awareness and Your Financial Well-being

Now that we’ve established the critical role of self-awareness in transforming your money mindset, let’s delve into how it directly impacts your financial well-being. The relationship between self-awareness and financial success is multifaceted and intertwined. Here are some of the key aspects to consider:

1. Improved Financial Decision-making

Self-awareness allows you to make more informed and conscious financial decisions. Instead of reacting impulsively to money triggers, you can approach decisions with a deeper understanding of how they align with your financial goals and values.

2. Reduced Financial Stress

Understanding the triggers of your financial stress can help you manage and mitigate them effectively. When you’re self-aware, you can implement stress-reduction strategies, such as budgeting, saving, and seeking support, to maintain a healthier relationship with money.

3. Goal Achievement

Setting clear and specific financial goals becomes more achievable with self-awareness. Your goals are aligned with your values and desires, and you’re more motivated to work towards them. This, in turn, increases your chances of success.

4. Enhanced Financial Resilience

The ability to embrace change and adapt your money mindset is a key component of financial resilience. In a world of economic uncertainty and constant flux, individuals who can adapt and grow are better equipped to weather financial storms.

5. Greater Financial Satisfaction

Ultimately, self-awareness leads to a greater sense of financial satisfaction. When your financial behaviors align with your values and goals, you experience a deeper sense of fulfillment and contentment in your financial journey.

Common Challenges in Developing Self-awareness

While self-awareness is a powerful tool in transforming your money mindset, it’s not without its challenges. Recognizing and addressing these obstacles is essential to making progress in your journey towards financial transformation. Here are some common challenges in developing self-awareness in the context of your money mindset:

1. Denial

Denial can be a significant barrier to self-awareness. It’s natural to resist acknowledging deep-seated financial beliefs or behaviors, especially if they are causing you distress. However, recognizing that denial exists is the first step in overcoming it.

2. Fear of Change

The prospect of changing your money mindset can be intimidating. Fear of the unknown, fear of failure, or fear of stepping out of your comfort zone can all hinder your progress. It’s essential to remember that change is a gradual process, and self-awareness can help you navigate it at your own pace.

3. Emotional Discomfort

Self-awareness often involves confronting difficult emotions and experiences related to money. It may be uncomfortable to explore the root causes of financial stress, guilt, or fear. Seek support from a therapist or counselor if these emotions become overwhelming.

4. Resistance to Feedback

Receiving feedback about your financial behaviors and beliefs can be challenging. You may be defensive or reluctant to accept differing viewpoints. Keep in mind that feedback from trusted sources can be invaluable in your journey toward self-awareness.

5. Lack of Time and Patience

Developing self-awareness takes time and patience. It’s not something that happens overnight. Consistent effort in activities such as journaling, self-reflection, or meditation is necessary for progress.

Cultivating Self-awareness in Everyday Life

To overcome these challenges, it’s crucial to actively work on cultivating self-awareness in your daily life. Here are some practical strategies to help you become more self-aware in your financial matters:

1. Practice Mindfulness

Mindfulness involves being fully present in the moment and observing your thoughts, emotions, and sensations without judgment. Apply mindfulness to your financial decisions by taking a pause before making choices and reflecting on your motivations and feelings.

2. Track Your Spending

Maintain a detailed record of your spending habits. Categorize your expenses and analyze where your money goes. This will help you identify patterns and make conscious decisions about your financial priorities.

3. Regularly Review Your Financial Goals

Frequently review and adjust your financial goals. Consider what changes in your life or values may require revisions to your objectives. This process ensures that your goals remain relevant and meaningful.

4. Seek External Perspectives

Engage in open conversations about money with friends, family, or a financial advisor. Different viewpoints can provide valuable insights and challenge your assumptions.

5. Learn from Your Mistakes

Don’t be too hard on yourself when you make financial mistakes. Use these experiences as opportunities for learning and self-discovery. Reflect on what led to the mistake and how you can avoid similar pitfalls in the future.

Self-awareness in the Entrepreneurial Context

Entrepreneurs, in particular, can benefit greatly from self-awareness in their financial journey. Whether you’re running a small business or embarking on a startup venture, self-awareness can significantly impact your success. Here are some ways in which self-awareness plays a crucial role in entrepreneurship:

1. Pricing Strategies

Self-awareness helps entrepreneurs recognize their tendencies regarding pricing. Are you underpricing your products or services due to self-doubt, or are you overpricing them out of fear of rejection? Being aware of your pricing patterns allows you to set competitive and profitable prices.

2. Risk Management

Entrepreneurship involves risk, and self-awareness can help you assess your risk tolerance. Are you too risk-averse or overly optimistic? Knowing your risk profile enables you to make informed decisions about investments and business strategies.

3. Financial Resilience

The ability to adapt and pivot in the face of financial challenges is crucial for entrepreneurs. Self-awareness enables you to understand your reactions to setbacks and stressors, making you more resilient in managing your business.

4. Decision-making

Entrepreneurs constantly face financial decisions, from budgeting and funding to hiring and expansion. Self-awareness ensures that these decisions align with your business’s core values and long-term goals.

Conclusion

Self-awareness is the linchpin of transforming your money mindset and improving your financial well-being. It empowers you to identify patterns, understand triggers, set clear financial goals, and embrace change in your relationship with money. Cultivating self-awareness in your daily life and acknowledging common challenges in the process are essential steps on your journey to financial transformation.

Whether you’re an individual seeking personal financial growth or an entrepreneur navigating the complexities of business finance, self-awareness can be your guiding light. By becoming more conscious of your financial beliefs, emotions, and behaviors, you can make more informed and conscious decisions, reduce financial stress, achieve your goals, and ultimately find greater satisfaction in your financial journey.

In the ever-changing landscape of personal and business finance, self-awareness is a timeless and invaluable asset that will continue to guide you toward a brighter financial future. Embrace the power of self-awareness, and watch as it transforms your money mindset and leads you to financial success.